Blog: Implementing National Frameworks for Nature Markets

,

A new private sector-led working group

by Simon Herko, May 2023

A range of International, UK and Scottish Government led programmes have been launched this year, that are set to establish a high-integrity nature finance market – with the intention of scaling up private investment in nature recovery and sustainable farming.

Programmes launched this year include:

With the voluntary biodiversity credits market currently forming out of the carbon market infrastructure, there is a real risk that the biodiversity credit market could go through a similar, damaging, ‘boom and bust’ cycle, caused by low-integrity biodiversity credit trades. This is the risk of waiting for the demand to dictate the market characteristics, without putting in place high-integrity mechanisms.

For this reason, the Scottish Government have also invested in a Civtech accelerator for designing a voluntary biodiversity credit for Scotland.

Understanding Credits

Carbon credit markets have been classified by the intervention type i.e., soil sequestration, solar power, clean water distribution, sustainable transportation, grasslands, cookstoves, wind, blue carbon, energy efficiency, reforestation, hydropower, urban forestry.

| The key difference between carbon and biodiversity credits is the non-fungibility of the underlying natural capital, and total focus on physical landscape and seascape assets. |

Therefore, the opportunity for Voluntary Biodiversity Credit (VBC) markets, with its multiple-measure approach, is to work at more of a bioregion scale i.e. linked to physical place. For Voluntary Biodiversity Credit markets to flourish, there is a need for:

- simplicity

- catalytic impact

- transparency

- accountability

- and community from the outset.

They need a set of clear definitions and governance principles alongside firm standards that can be practically applied and enforced at a project level. As projects are linked to physical place, there is a strong need to link standards to local policies on land rights and responsibilities. The Woodland Carbon Code is a good example of Scotland creating a helpful mechanism for Voluntary Carbon Credits, that can be used across the whole of the UK, albeit restricted to UK-based buyers, and therefore a reduced impact on the global trading system.

There are two quite different policy positions on domestic Voluntary Carbon Markets – one is to retain any carbon abatement for UK net zero targets by restricting overseas investment, increasing the likelihood that we meet our targets and that these markets help (the position that the Woodland Carbon Code and Peatland Code have taken to date). The other is that these markets could attract significant inward investment that is worth making corresponding adjustments for, so the carbon abatement counts towards the country from where the investment comes.

Most of the emerging Voluntary Carbon Markets in the UK have yet to decide on this, and there is nothing to stop international verified carbon standards, like Verra’s, operating in the UK with overseas investment – indeed there are companies trying to get VM0042 Methodology for Improved Agricultural Land Management up and running for agricultural soil carbon in the UK now.

Introducing the Nature Finance Certification Alliance (NFCA)

Currently formed as an exploratory sub-group of the Scottish Nature Finance Pioneers, the mission is to tackle the uncertainty surrounding nature finance transactions by creating an informed marketplace, using Scotland as the pilot-case, with plans to expand our influence across the UK, and Internationally. The governance is based upon organisational membership, with the following private companies already signed up:

abrdn

CreditNature

Rhizocore Technologies

SAC Consulting

Finance Earth

Highlands Rewilding

Kana

Oxygen Conservation

Palladium

Rathbone Greenbank Investments

Wildlife Works

The group also benefits from a range of civil servant observers and academic contributors, including officers from Scottish Government, NatureScot, SEPA, Scottish Forestry, Scottish Land Commission and SRUC.

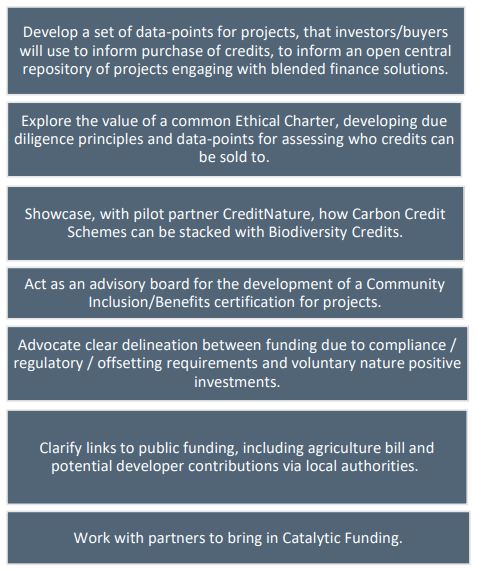

This mission is underpinned by the following impact pathways:

Further development of the mission and scope would be driven by the membership of the NFCA, with close attention to ensuring this mission and scope complements that of the international efforts being made, including the work of:

- British Standards Institute

- Biodiversity Credits Alliance

- World Economic Forum

- Taskforce on Nature Related Financial Disclosures (TNFD)

- Taskforce on Nature Markets (TNM)

- Science Based Targets Initiative (SBTi)

- Verra

Founding Values

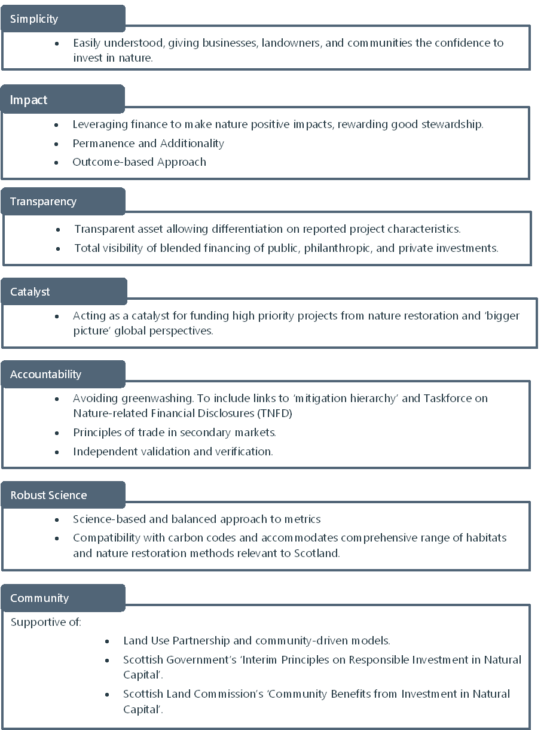

Through the work undertaken by the NFCA and in co-ordination with key stakeholders, including Scottish Government, NatureScot and SEPA, we have established the following founding values for NFCA, that are also shared with the wider Scottish Nature Finance Pioneers impact network.

If you’d like to get involved in the work of the NFCA please don’t hesitate to get in touch with me at secretariat@natcert.earth

Find out more Nature Finance Certification Alliance (natcert.earth)